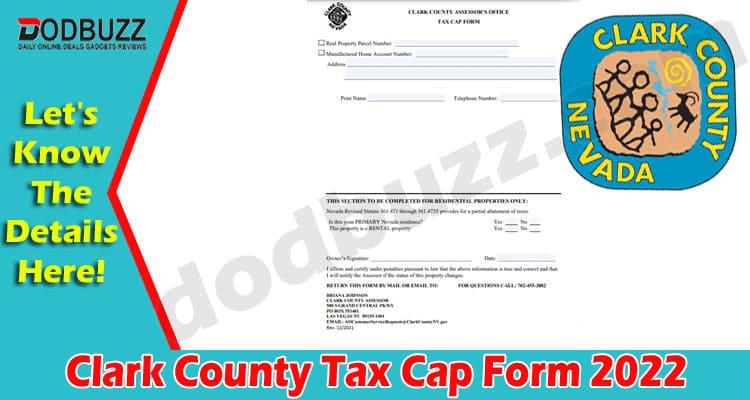

This post on Clark County Tax Cap Form will give you all updates regarding the residential property form and from where you can get the form.

Have you filled out tax cap forms? Do you know the last date of filing this form? If you are searching for all such details from online sources, then this post will help you. Many people in the United States seek Clark County Tax Cap Form. So, we will provide all the details related to this form in this post.

Kindly stay tuned to this post to know the ways and deadline to fill out the form.

Tax Cap Form 2022

Those who want to fill out the Tax Cap form for the fiscal year 2021-22 can collect the forms from Clark County Office and fill out the Tax Cap Form on Wednesday, June 29, 2022. Clark County is where the primary residents can avail of the forms, and if they submit them by Thursday, June 30, 2022, they will get up to a 3% cap for 2021-22.

Temp Tax Cap Form 22

This type of form is to be filled out by those residents who have bought the property. It is filled by the residents who buy homes. Everyone who bought new property rushed immediately to the County Clark office to get the form and fill and submit it immediately as soon as possible. As per the reports, a group of around 40 people rushed to the office to take the form. The form was out on June 29, 2022. By Thursday, people will get around a 3% cap if they submit to the respective authority. This made people rush to the office, and everyone was trying to submit it as soon as possible.

Clark County Assessors Office

As per the details shared by the Assessor’s office, those who have bought a home before July 1, 2021, can correct the Tax Cap Form. While residents who have purchased property or home before July 1, 2021, acquire the incorrect Tax Cap Form. They can also correct the form for the current fiscal year. Moreover, the Temp Tax Form can be submitted directly to the assessor’s office. You can submit it at S. Grand Central Parkway 500. The residents can also email the tax cap form to AOCustomerServiceRequests@ClarkCountyNV.gov.

We have provided all relevant details on Clark County Tax Cap Form from this post. If you want extra advantages, kindly hurry up and fill out this form immediately. The residents can check the details to submit the form from this section.

Conclusion

Summing up this post, we have informed all our readers to file the Tax Cap Form. Also, the deadline to get a 3% cap is mentioned in this post. The residents can install the form from the official website of the Clark Assessor Office. The residents who still have an incorrect form can also correct it today. So, hurry up and get the form as soon as possible.

Have you filled out the Clark County Tax Cap Form? Please let us know in the comment section mentioned below.

Also Read : – Turbotax 2022 Extension {April} Get The Entire Detail!